Buy Virtual Bank Accounts

Buy Virtual Bank Accounts

We have a fully approved virtual bank account available for Buy.

- The account is active and working functionally.

- It has completed all verification steps.

- This is a premium group buy account.

- You can use this account from any country in the world.

- it was set up with a genuine, dedicated IP address.

Highlights on Buy Virtual Bank Accounts.

- Trusted seller of virtual bank accounts.

- Reasonable price point.

- Full account verification is done.

- It was set up using a unique and genuine IP address.

- Fast delivery of the virtual bank account.

- Dedicated customer support.

25.00$

Best Online Bank Accounts or Buy Virtual Bank Accounts

As we continue to embrace the digital age, it’s no surprise that online banking has become a popular choice for many individuals and businesses. With its convenience and ease of use, online bank accounts offer a range of benefits compared to traditional brick-and-mortar banks.

But with so many options available, how do you choose the best online bank account or buy virtual bank accounts? Let’s delve deeper into what makes an online bank account stand out from the rest.

Convenience is Key

One of the main reasons people opt for online bank accounts is the convenience they offer. Gone are the days where you have to wait in long lines at the bank or make time during your busy day to visit a physical branch. With online bank accounts, you can access your account 24/7 from the comfort of your own home or while on-the-go.

Not only that, but online banking also allows you to easily transfer funds between accounts and even pay bills with just a few clicks. This level of convenience makes managing your finances much easier and less time-consuming.

Lower Fees and Higher Interest Rates

Another advantage of choosing an online bank account is the potential for lower fees and higher interest rates. Without the overhead costs associated with physical branches, online banks are often able to offer better rates for services such as checking accounts, savings accounts, and loans.

In addition, many online banks have no monthly maintenance fees, no minimum balance requirements, and even reimburse ATM fees. This means you can save money while still enjoying the same services that traditional banks offer.

Security is a Top Priority

Some may have concerns about the security of online banking, but rest assured that most reputable online banks use advanced encryption technology to protect your personal and financial information. In fact, many experts argue that online banking is actually safer than traditional banking as there is less risk of human error or fraud at physical branches.

Furthermore, most online banks provide additional security measures such as two-factor authentication and fraud monitoring to ensure your account stays secure.

Customer-Centric Approach

One aspect that sets the best online bank accounts apart from the rest is their customer-centric approach. With fewer physical branches, online banks place a strong emphasis on providing exceptional customer service through various channels such as live chat, email, and phone support.

Not only that, but many online banks also offer personalized financial planning services and tools to help you reach your financial goals. This level of care and attention to their customers’ needs sets them apart from traditional banks that may have a more transactional approach.

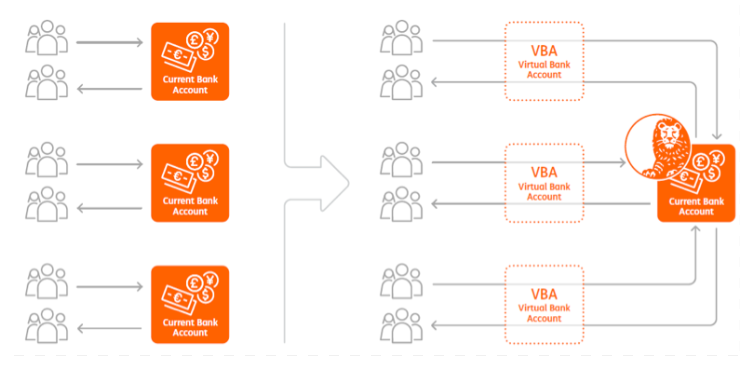

What is a Virtual Bank Account?

A virtual bank account, also known as an online or digital bank account, is a type of bank account that exists entirely in the digital world. Unlike traditional bank accounts, you cannot walk into a physical branch to access your virtual bank account.

Virtual bank accounts are typically offered by online banks and can be accessed through their website or mobile app. They function just like traditional bank accounts, allowing you to deposit and withdraw funds, make transfers, and more.

Buying Virtual Bank Accounts

Nowadays, it’s possible to buy virtual bank accounts from various providers. This option is especially useful for those who are unable to open a traditional bank account due to certain restrictions or for those looking for additional features such as multi-currency accounts.

When buying a virtual bank account, it’s important to do your research and choose a reputable provider. Look for reviews, customer testimonials, and ensure that the provider has strict security measures in place to protect your information.

What are the Benefits of Buy Virtual Bank Accounts?

Buying a virtual bank account has its own set of benefits, including:

- No credit checks or documentation required: Unlike traditional bank accounts, most providers do not require any credit checks or lengthy documentation when buying a virtual bank account.

- Accessibility: Virtual bank accounts can be accessed from anywhere with an internet connection. This is especially useful for those who travel frequently or have remote clients.

- Increased privacy: Virtual bank accounts offer a certain level of anonymity as your personal information is not tied to a physical branch.

In conclusion, online banking and virtual bank accounts offer numerous advantages over traditional banks. From convenience and better rates to advanced security measures and exceptional customer service, it’s no wonder more and more individuals and businesses are making the switch. When considering an online bank account or buying a virtual bank account, be sure to do your research and choose a reputable provider that meets your specific needs and preferences.

Additional Content: Choosing the Right Online Bank Account

While convenience, lower fees, security, and a customer-centric approach are important factors when choosing an online bank account or buying virtual bank accounts, it’s also crucial to consider your individual financial needs.

For example, if you frequently travel internationally for business or leisure, it may be beneficial to choose an online bank account that offers multi-currency options and low foreign transaction fees. On the other hand, if you value high-interest savings accounts and money management tools, look for a provider that offers these features.

It’s also important to assess the user experience of the online bank or virtual bank account provider. Do they have a user-friendly website or mobile app? Is their customer service easily accessible and helpful?

Ultimately, choosing the right online bank account will depend on your specific financial goals and preferences. Be sure to carefully research and compare different options before making a decision. With the right online bank account or virtual bank account, you can simplify your financial management and take advantage of all the benefits that digital banking has to offer.

Where to Buy a Virtual Bank Account?

If you’re interested in buying a virtual bank account, there are many reputable providers to choose from. Some popular options include:

- Transferwise

- Revolut

- N26

- Monese

It’s important to carefully research each provider and their offerings before making a decision. Consider aspects such as fees, features, customer reviews, and security measures.

In addition, it may be helpful to seek recommendations from friends or family who have experience with virtual bank accounts or online banking.

Remember, the right provider for one person may not necessarily be the best fit for another. So take your time and make an informed decision that aligns with your individual financial needs and goals. With the convenience and flexibility of digital banking, managing your finances has never been easier.

Key Facts About Online Bank Accounts With Instant Virtual Debit Cards

- Virtual bank accounts offer the convenience of instant virtual debit cards, which can be used for online purchases and transactions.

- These cards are linked to your virtual bank account and can be easily managed through an online banking platform or mobile app.

- Instant virtual debit cards provide added security as they do not require physical transfer or sharing of sensitive information like card numbers.

- Some providers may also offer the option to customize your virtual debit card with a unique design or image.

With all these benefits, it’s no wonder that more people are turning towards virtual bank accounts with instant virtual debit cards for their everyday transactions.

Best Online Bank Accounts With Instant Virtual Debit Cards

As the demand for virtual bank accounts with instant virtual debit cards grows, so does the number of providers offering this service. Some top options include:

- Chime

- Varo Money

- BlueVine

- Aspiration

Be sure to research each provider and compare factors such as fees, features, and customer reviews before making a decision. With the right online bank account and instant virtual debit card, you can enjoy seamless financial management from anywhere in the world.

Final Thoughts on Online Banking and Virtual Bank Accounts

In today’s fast-paced world, convenience is key. And when it comes to managing our finances, online banking and virtual bank accounts offer just that.

With lower fees, enhanced security measures, and a customer-centric approach, these modern banking options have revolutionized the way we handle our money.

Here are some top online bank accounts that offer instant virtual debit cards:

Chime: With no monthly fees and an easy-to-use mobile app, Chime is a popular choice for online banking.

Varo Money: This online bank account comes with automatic savings tools and low foreign transaction fees.

BlueVine: Ideal for small business owners, BlueVine offers high-interest savings accounts and convenient invoice financing options.

Aspiration: Offering cash-back rewards on purchases made with their instant virtual debit card, Aspiration also allows you to choose the fee amount you pay each month.

Best Accounts With Online Debit Cards by Country

- United States: Ally Bank, Capital One 360, Simple

- United Kingdom: Monzo, Starling Bank, Revolut

- Canada: Tangerine, EQ Bank, Scotiabank

- Australia: ING, UBank, St.George

With so many options available in different countries, it’s important to research and compare features and fees before choosing the best account for your needs. And as technology continues to advance and disrupt traditional banking systems, we can expect more innovative solutions to emerge in the future.

Here are some of the best online bank accounts with instant virtual debit cards by country:

United States

- Chime: No monthly fees and an easy-to-use mobile app.

- Ally Bank: High-interest savings accounts and no minimum balance requirements.

- Capital One 360: Offers a wide range of financial products and services, including checking, savings, and investment accounts.

United Kingdom

- Monzo: User-friendly app with budgeting tools and low foreign transaction fees.

- Starling Bank: Instantly freeze or unfreeze your card in case of loss or theft, plus lower international ATM fees.

- Revolut: Multi-currency account with cheap exchange rates for international transactions.

Canada

- Tangerine: Fee-free banking options with high-interest savings accounts available.

- EQ Bank: Offers high interest rates on savings accounts and GICs (Guaranteed Investment Certificates).

- Scotiabank: Provides a wide range of traditional banking services along with online and mobile banking options.

Australia

- ING: No monthly fees and high-interest savings accounts available.

- UBank: Offers competitive interest rates on savings accounts, term deposits, and home loans.

- St.George: Comprehensive suite of personal and business banking products with easy online and mobile access.

Whether you’re based in the US, UK, Canada, or Australia, there are plenty of options for virtual bank accounts with instant virtual debit cards to choose from.

European Union/EEA

- N26: Offers various banking products with a sleek and user-friendly app.

- Revolut: Multi-currency account with cheap exchange rates for international transactions.

- Monese: Allows customers to open an account without a local address or credit check.

As the demand for digital banking services increases, we can expect even more innovative solutions to emerge in the future. With virtual bank accounts and instant virtual debit cards, managing your finances has never been easier or more convenient.

India

- ICICI Bank: Offers a variety of banking products with online and mobile access.

- Kotak Mahindra Bank: Provides virtual debit cards for easy online transactions.

- Axis Bank: Allows customers to open an account without visiting a branch location.

With the growing trend of digitalization in India, more and more banks are offering online and mobile banking services. These options offer convenience, security, and customer-centric features that make managing your finances easier than ever before. Don’t wait any longer, start exploring your options today!

Japan

- Rakuten Bank: Offers a wide range of financial products and services, including mobile and online banking.

- Mizuho Bank: Allows customers to open an account without visiting a branch location.

- Sony Bank: Offers competitive interest rates on savings accounts and investment products.

As the world becomes more digitally connected, traditional banks are facing increasing competition from digital-only banks in Japan. With features like online and mobile banking, virtual debit cards, and budgeting tools, these virtual banks are revolutionizing the way people manage their money.

Nigeria

- Paga: Offers mobile banking and payment services, including bill payments and money transfers.

- Kuda Bank: Provides fee-free banking options with virtual debit cards.

- Alat by Wema Bank: Offers a fully digital banking experience with online account opening and budgeting tools.

In Nigeria, traditional banks are facing competition from digital-only banks like Paga, Kuda Bank, and Alat by Wema Bank. These virtual banks offer convenience, security, and customer-centric features for managing your finances on-the-go. With options like mobile banking, online account opening, and budgeting tools available, it’s never been easier to take control of your money in Nigeria.

How do I deposit cash with an online checking account?

Depositing cash with an online checking account can be done through various methods, such as:

- Direct deposit: Many employers offer the option to have your paycheck directly deposited into your online checking account.

- Cash deposit at an affiliated bank or ATM: Some online banks have partnerships with traditional banks or ATM networks where customers can make cash deposits for a fee.

- Mobile check deposit: Most online banks have a mobile app that allows you to take a picture of a physical check and submit it for deposit.

- Money transfer services: You can use services like Venmo, PayPal, or Zelle to transfer money from another account or receive payments from friends and family.

It’s always best to check with your specific online bank for their available deposit methods and any associated fees. With the convenience of digital banking, managing your finances has never been easier.

Compare Online Banks With Instant Virtual Debit Cards

Instant virtual debit cards are a popular feature offered by many online banks, providing customers with immediate access to their funds and the ability to make purchases online without having to wait for a physical card. Here are some top online banks that offer this convenient feature:

- Chime: With Chime’s SpotMe feature, customers can instantly access up to $100 of overdraft protection at no additional cost.

- Revolut: This digital bank allows users to create multiple virtual debit cards for different purposes, such as budgeting or security.

- N26: Along with instant virtual debit cards, N26 also offers cashback rewards on certain purchases made with their virtual card.

- Ally Bank: Customers can easily create or disable virtual debit cards through the Ally Mobile app.

When comparing online banks with instant virtual debit card options, be sure to consider fees, features, and security measures. With the right bank and card for your needs, you can enjoy the convenience and ease of using a virtual card for your transactions.

Other Guides to Online Checking Accounts

As the popularity of online checking accounts continues to grow, there are many resources available to help you make the most out of your digital banking experience. Here are some other guides and tips to consider:

- Budgeting tools: Many online banks offer budgeting tools and features that can help you track your spending and save money.

- Security measures: Online banks often have advanced security measures in place, such as two-factor authentication and fraud alerts, to protect your account from unauthorized access.

- Customer support: With 24/7 customer support through various channels like phone, email, or live chat, you can easily get assistance with any issues or questions you may have.

- Interest rates: Some online checking accounts offer competitive interest rates, allowing you to earn money on your deposits.

By utilizing these resources and tips, you can make the most out of your online checking account and take control of your finances.

Why Choose Us to Buy Virtual Bank Accounts?

When it comes to buying virtual bank accounts, there are plenty of options available. However, choosing the right provider is crucial for a safe and secure experience. Here’s why you should choose us for your virtual bank account needs:

- Trusted and reliable: We have a proven track record of providing high-quality virtual bank accounts to satisfied customers.

- Affordable prices: Our virtual bank accounts come at competitive prices, making it accessible to everyone.

- Quick and easy process: With our streamlined process, you can purchase a virtual bank account in just a few simple steps.

- Secure transactions: We prioritize security and use advanced encryption technology to protect your personal and financial information.

- Customer support: We have a dedicated customer support team available to assist you with any questions or concerns.

Don’t take a risk with your virtual bank account – choose us for a seamless and secure experience. With our services, you can confidently make purchases and manage your finances online.

Final Words on buy virtual bank accounts:

In today’s digital age, online banking has become a necessity for convenience and security. With virtual bank accounts, you can access your funds instantly and make purchases online without any hassle. By choosing the right provider and utilizing the resources available, you can make the most out of your digital banking experience.

Additional Benefits of Virtual Bank Accounts

Aside from convenience and security, there are several other benefits of having a virtual bank account that may be worth considering:

- International transactions: Virtual bank accounts can often facilitate international transactions at lower fees than traditional banks.

- No credit checks: Unlike traditional banks, virtual bank accounts typically do not require a credit check for opening an account.

- No physical branches: With virtual bank accounts, you don’t have to worry about commuting or queuing up at a physical branch. Everything can be done online from the comfort of your own home.

- Personalized budgeting: Many virtual bank accounts offer features that allow you to set spending limits and track your expenses, making it easier to stick to a budget.

With these added benefits, it’s no surprise that more and more people are turning to virtual bank accounts as their primary banking option.

There are no reviews yet.